How to Appeal a Life Insurance Denial

Iif there’s anything worse than getting sick, it’s getting sick while dealing with insurance. But unfortunately, that situation is very common. A recent survey from the Commonwealth Fund, a private agency that researches health care issues, finds that 17% of US adults last year turned down their company. of insurance to refuse care recommended by a doctor, and refusal occurs more often in business and commercial people. government insurance plans.

Refusal can happen before you receive a test, procedure, or treatment—when a provider submits a request for prior authorization, for example—or after you receive care. The insurer may argue that the service is not covered or medically necessary for you, or it may deny care for administrative reasons, such as a claim with incorrect information. or from an offline provider.

Receiving a rejection letter can be frustrating, but you can take some steps to fight back. Here is what you should do.

Read your rejection letter thoroughly

It’s easy to let your eyes glaze over when you’re faced with a wordy letter, but it’s important to read it carefully, says Jeremy Gurewitz, CEO of Solace, a company that connects consumers and advocates to help them manage the health system. Your letter should explain exactly why you were denied coverage—and that reason is important to know, Gurewitz says, because it determines your next steps. Your case may require a formal amendment, such as providing additional documents or refiling the claim with different details. Or, it may be necessary to put together a petition to argue that your doctor’s treatment plan is, in fact, necessary. Gurewitz recommends starting by calling your insurer’s customer service line, as some issues can be resolved over the phone.

Read more: Does Text Therapy Really Work?

Insurance companies also make mistakes “all the time,” Gurewitz says, so don’t assume your denial letter is valid and give up right away. Check your policy documents to make sure what the insurer claims is true, and ask them to correct any mistakes you find.

Appeal

Even if your refusal cannot be easily reversed – such as if the company argues that the service is unnecessary, or you mistakenly see an out-of-network provider – you still have elections.

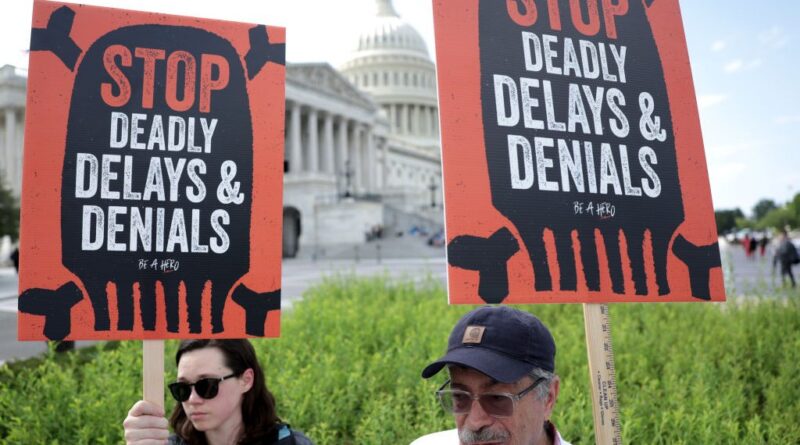

“Never take ‘no’ as the last answer,” says Wendell Potter, a former Cigna executive turned care reform advocate. of health after he left the company in 2008. “Insurance companies expect people to subscribe to their health. plans to simply accept whatever they decide to do because [pushing back] it’s complicated. It’s a burden. It’s hard work.”

However, people who take the time to appeal often get good results. A recent Commonwealth Fund report found that half of people who challenged insurance denials ultimately received partial approval, or approval for the same service. (The same goes for medical bills. Recent research suggests more than 60% of people who try to negotiate with their health bills successfully get a price adjustment.)

Putting together a good appeal requires doing your homework, however. First, go back to your denial letter, which should include information about how to file an appeal and, possibly, specific instructions about what to include and how, Gurewitz says. This information should also be available on your insurer’s website.

If you are denied due to medical necessity, your goal is to explain a clear, compelling reason why you need the treatment, procedure, or medication. If you can, get your doctor involved, recommends Diane Spicer, attorney in charge of Community Health Advocates (CHA), a group that helps New Yorkers navigate the health care system. This can be tricky, as sellers aren’t always willing or able to make the time, he says. But if your doctor provides a detailed argument about medical necessity, backed up by medical records and clinical data, it strengthens your case significantly, he says.

The doctor may choose to write a letter or give you a statement to include in your letter. You can also search for a template letter online and send it to your doctor as a sample.

Read more: How To Make A Long Lasting Friendship Work

You also have the right to question the criteria your insurer used to make its decision, Spicer says. The best way to find this, as well as other records related to your case, is to request your “claim file.” You can compare insurance decision-making processes with national standards of care for your condition; If your insurer is trying to enforce more stringent conditions than usual, you can include that information in your claim.

To find these national standards, Spicer recommends using a search term such as, “Guidelines for the diagnosis, management and treatment of this disease. [insert name of condition, being as specific as possible].” Search results will often lead you to reports or guidelines from state health agencies. You can also search UpToDate, a database that collects information about evidence-based health care practices, but requires a fee.

If you’re denied because you were caught by an out-of-network provider, you may still be able to appeal, Spicer says. The No Surprises Act protects consumers in a variety of situations, such as when you are treated by an out-of-network doctor during an emergency or a provider is mistakenly listed as in-network in the insurer’s database.

Insurers often request that the appeal be sent by post. If so, it’s “very important” to send yours via certified email so you can track it, Gurewitz says. “You have to have a paper trail,” he says.

Add

If your appeal is denied, that’s still not the end of the road. If the company continues to stand by its original decision, you can request an external review where someone reviews the case.

You also don’t have to stop filing appeals through official channels, Potter says. Consider alerting insurance company executives, regulatory boards, local politicians, or the media to generate pressure. This works best, Potter admits, if you have a compelling or dramatic story—if the company’s refusal has forced you to delay care or cause serious financial problems. , for example. If you don’t want to go too nuclear, you can always call out the company on social media, Potter says.

“Being a cog is important,” Potter says. When he worked at Cigna, he says, the company had a system for handling “high-profile” cases, like the one that caught the attention of a reporter. He says: “After a long time, that denial would change.”

Get help

If all this sounds overwhelming, call the experts. Health advocates can help put together a strong appeal, as they know the ins and outs of the system and what has worked with certain insurers in the past.

Consumers can work with health advocates, whose services are often free, through private companies like Solace, charities like the Patient Advocate Foundation, or specialized government agencies like CHA. Sometimes, employers even offer health advocacy services as an employee benefit. The soon-to-be-launched Claimable also promises to use artificial intelligence to organize medical surveys, information about your insurance plan and health history, and details of past claims to make a One that has a better shot at the job.

No matter which path you take, it’s important to remember that there are people who can help, Gurewitz says. “When you or a loved one is suffering from a serious illness, the last thing you want to do is check the paperwork,” he says.

#Appeal #Life #Insurance #Denial